I have been, many times over the last two years, been asked to make public my views of the capital markets. so here we go, this venue should be as good as any.

it has been so hard to offer views or to write about what the market reactions may be to US elections when Donald Trump wins even though he is miring himself all over the place and due to major complacency towards his becoming the president of America. it seems people that like his views, do choose to forgive him any time he makes mistake or makes a wrong turn for the simple reason, he is just pointing out the obvious about politics inability to move forward and to please constituents' expectations and needs any more as it may have run its course and I feel, will have to take a breather after so many decades of running and make way to new currents. politicians truly have taken all for granted. that is not to ignore the same politicians and people that have elected them all along have been the key factors for our present democracy, freedom and all the good things we have been blessed with. and the way he wins, the model, is going to spread all over the free world and slowly trickle down to other lesser structured democracies and possibly even the third world. people that oppose him now, hopefully, unintentionally accuse him of protectionism. that is utterly nonsense. that is merely a justified reaction as all elemnts have run their course for the time being and need to give way to new bumps in the overall evolution and may be even currents and trends. I assume they need to scare monger or they have the right to be making wrong judgements which over the time may be corrected, molded or changed altogether. because they are going to see the same way.

frankly, I am not so sure how much of what he is saying he will actually manage to accomplish during his tenure as a president for the simple reason that the market dynamics are much stronger then any government and their ideologies. Trump is not advocating he is going to be functioning out of those dynamics and elements. how could he as he is a product of just that.

he probable will be a new merely consideration-worthy view offering along for the market evolution for the better once the world comes to new understanding of better co-existence.

OK, enough with politics entangled views and let us move on with what I see in the markets and how they will looking out the next six months to three year time horizon. we are going to focus on currencies mainly as they are ripe for sharp moves some more. and few other markets as well in the following;

it seems that we should be awaiting and then embracing the idea of 50 cent Canadian Dollar to the USD, or the other way around would be the 1 USD to 2 CAD within the next three years. the pattern and the Elliot wave trading charts and other elements taken into account along with the fact it has jus broken out of a six month bottoming out range quite strongly. Canadian housing market has usually correlated with weak CAD and after mulling over the TSX HOUSE BUILDERS MID CAP charts which shows it has topped out for now and needs to crash a 25% to 40%. but if it does which I feel will certainly do, it must stay there for a long time to come. so, the dampening housing market along with a very weak CAD.

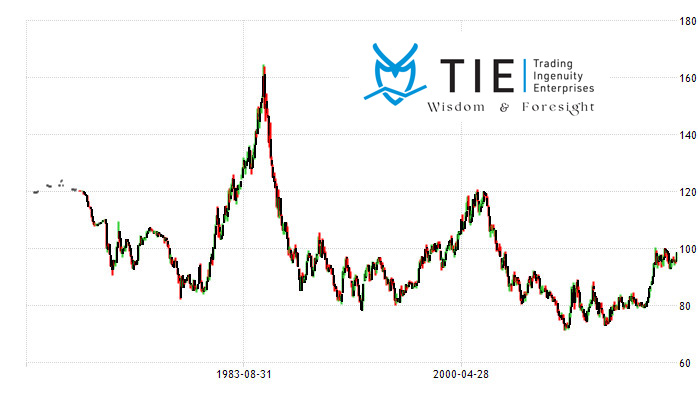

DXY historical charts suggest that USD will come very close and may even breach the recent highs this year and within the next three years it shall surge past the President Reagan era highs. that is to say that all currencies except for the Sterling that has more to approach lows and parity but not to visit it, shall come under enormous pressure;

Kiwi past 40 cents, Aussie past 50 cents and these are currencies with value in them, then you can draw your conclusion as to worthless major currencies such as Euro and Yen. Euro past 82 cents and Yen past 145.

what should take place with commodities;

well, contrary to prevailing view that the crude is going to trade above $51, just does not sit right with my view of the patterns that have developed over the last 8 years, and six months, and three weeks, I feel, we are going to revisit the recent lows of $25 and below that, to low teens next year and half.

I am not sure about the gold as it is in the middle and stubbornly trying to go higher. I would think, even though it may not make sense when trading against the dollar, it even is probably grinding higher. and as for the rest of CRB index, It seems vulnerable to the same market reaction to the DXY phenomenal- like strength.

as for indices, I have no longer term view just yet except a sudden drop pretty soon almost very where in the major countries.

in closing, to summarize, keeping with the current trend is strongly advised.

happy trading/ investing. I shall be back soon with some more comments.

moe tabrizi,

capital markets' analyst

trading ingenuity